Fixed rate mortgage break cost calculator

In the second year of your fixed-rate contract you decide to refinance which means you need to break the contract. Example 3 - rates rise.

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

300000 Remaining Mortgage Balance 325 Current Mortgage Interest Rate.

. Or Refinance and Take Cash Out. Our estimate figures out the banks cost of money based on wholesale swap rates and the. Use a mortgage refinance calculator to determine the breakeven point which is the.

Your estimated mortgage break penalty is. Here Adam explains that even if the cost of breaking a loan may be high if the benefit of breaking makes sense it may be the best idea. 243750 How is my mortgage penalty calculated.

If you refinance your loan but you still have time left on your fixed term you can be charged break costs. The current average 30-year fixed mortgage rate climbed 7 basis points from 570 to 577 on Monday Zillow announced. 100000 04 x 1 year 400.

Ratehubcas mortgage penalty calculator. See our rates experience our tools or simply talk to one of our experts. This calculator generates an estimate.

Wanting to get out of a fixed mortgage is the most common mortgage that I see people question. On a 30-year jumbo. Our break costs formula is complex.

In this case it would be 500000 500 - 400 3 which ends up as 500000 100 3 15000. During this time your lenders fixed rate was reduced to. The 30-year fixed mortgage rate on September 5 2022 is up 15.

Ad Our non-commissioned mortgage experts are ready to help. 21 rows A fixed loan break-cost calculator could help you work out what kind of fee youll be charged when you break a fixed rate loan contract early usually due to selling a. Break fees - Value not cost Loan amount Current.

This quick calculator will show you how much it may cost to prepay your mortgage in part or in full. The original wholesale interest rate when the fixed interest rate period started then a Break Cost will be charged. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. When you look into breaking a fixed. The most significant factor affecting your monthly mortgage payment is the interest rate.

Ad Work with One of Our Specialists to Save You More Money Today. Break cost Loan amount x Change in Interest Rate x Time remaining on loan As an example lets say you borrowed 500000 on a fixed-rate home loan with a loan term of 5. Total Savings Break Even.

Breaking a fixed mortgage rate. Use our free mortgage calculator to estimate your monthly mortgage payments. Break cost loan x interest rate change x time left on the loan To demonstrate this imagine a customer has a five-year fixed rate loan of 400000 paying a 5 interest rate.

Refinancing before the end of your fixed term. If a Fixed Rate mortgage loan is fully or partially repaid early or you change to a different interest rate during the fixed rate term an early breakage cost may be applicable. We will incur a loss and you will have to pay break costs if on the day a prepayment or switch is made the wholesale.

Call now or request a callback and well be back in. This is a simplified description. The difference between the wholesale interest rate at the start of the fixed.

Bank of Ireland can relend to the market at -04 instead of the 0 they borrowed at so the breakage fee is. If the rate since the loan was taken out has increased there will likely be no rate. Dont Wait Take Advantage of Todays Historically Low Rates With Pennymac Today.

If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan. Ad You Could be Saving Hundreds by Refinancing Your Mortgage. Account for interest rates and break down payments in an easy to use amortization schedule.

Only the bank itself can give you exact numbers. We can help you with all your break cost questions and give you a break cost quote if youre thinking of ending your fixed period early. Before getting started please keep the following in mind.

Fixed rate holders pay the greater of interest rate differential or three months interest while variable rate holders pay just three months interest. The tool estimates the.

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator Money

Loan Amortization Schedule Calculator Spreadsheet Templates

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator

Excel Formula Estimate Mortgage Payment Exceljet

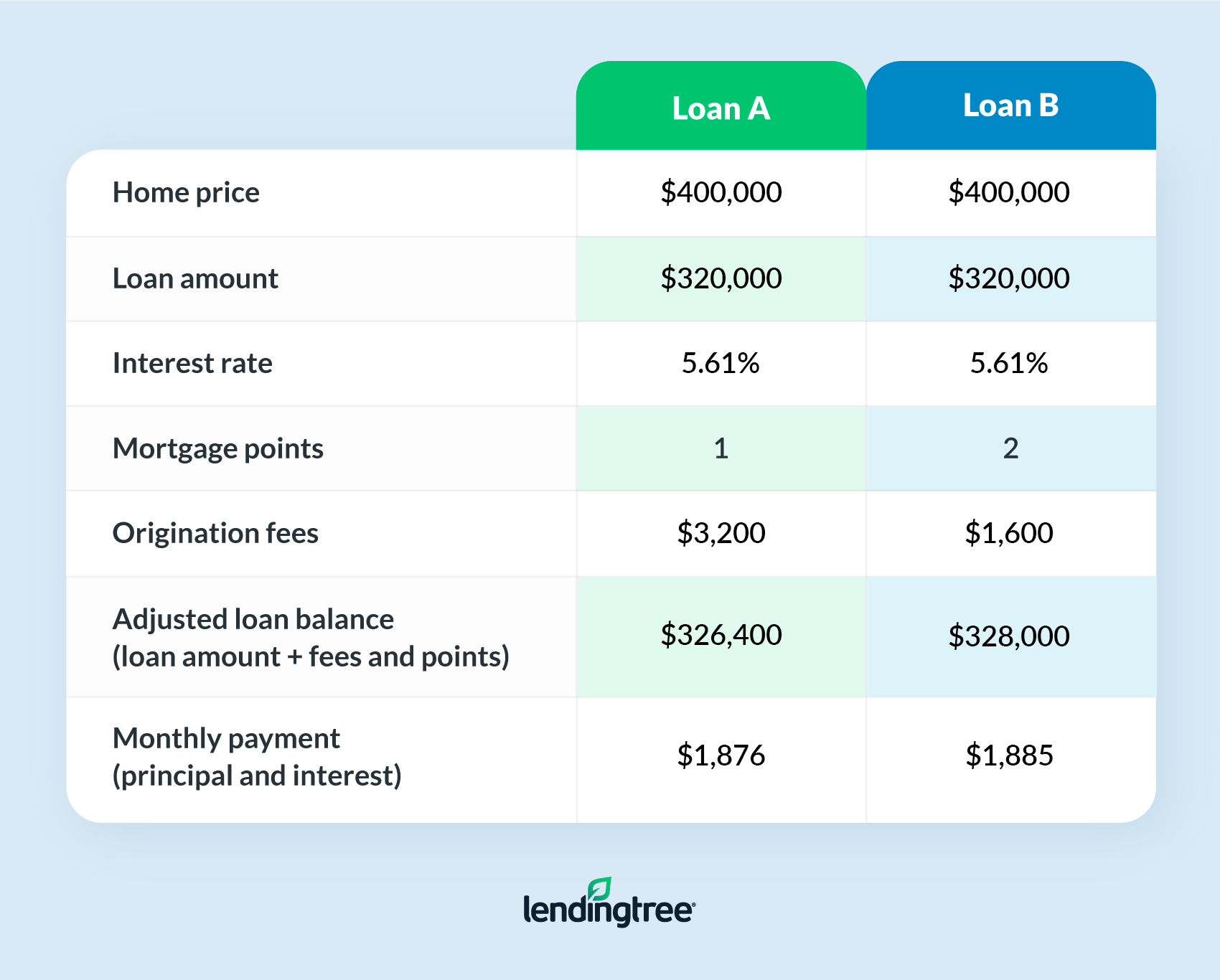

Mortgage Points A Complete Guide Rocket Mortgage

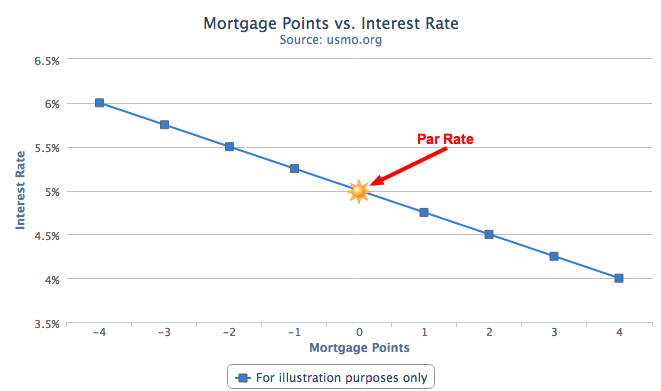

Understanding Mortgage Points U S Mortgage Calculator

Downloadable Free Mortgage Calculator Tool

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Mortgage Refinance Rates Best Cash Out Home Refinancing Loan Rates

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Discount Points Calculator How To Calculate Mortgage Points

How To Calculate Your Mortgage Prepayment Penalty Zoocasa Blog

The Mortgage Center Financial Calculators Com

![]()

Discount Points Break Even Calculator Home Mortgage Discount Points Explained

When Should You Lock In Your Variable To A Fixed Rate Mortgage

Apr Vs Interest Rate What S The Difference Lendingtree